G.S.T has been a riddle for every business owner since inception, we are trying every day to make it simple for you. Give us a try !

We will segregate the bills, make entries for you, experience complete peace of mind.

Our system automation help us to validate all the bills inputs through GST Server.

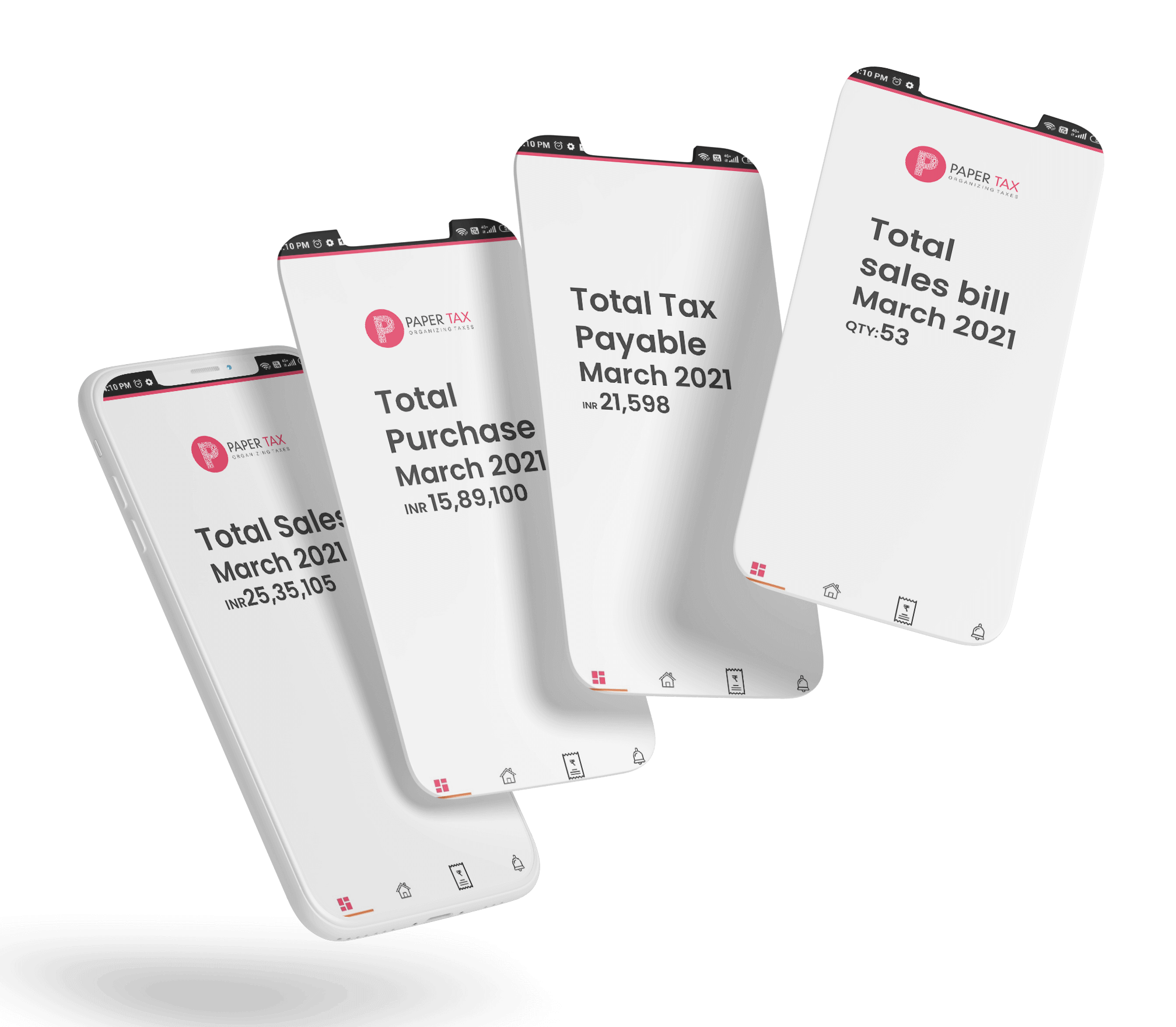

Get more than 50 parameters analytics for your filed return, get to know your statistics well.

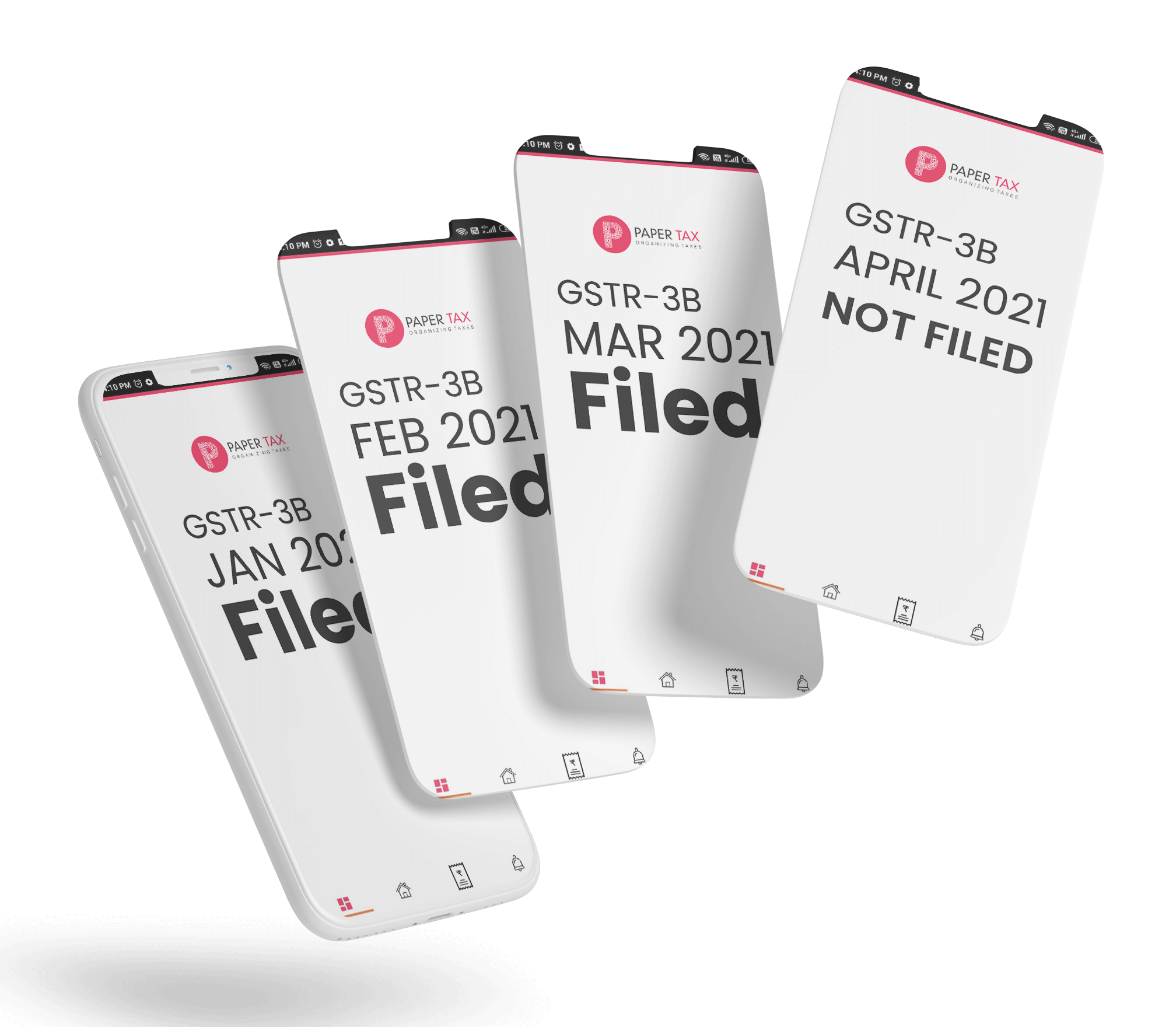

Lots of figures in GST Returns makes it prone to clerical error while filing, dont worry, we have a 3 layer process to catch even the smallest mistake.

Matching input tax credit to bills, checking eligibility of credit, following up to the party who has not passed the input, is altogether an important but significantly a waste of time for business owners.

Paper tax endeavour is to make G.S.T compliance easy and at the same time keep your G.S.T stuff at your finger tips.

Dedicated support & a Paper tax wallet helps you to pay tax challan in a transparent way.

At all the crucial stages of your tax return you will be notified via mail, message & calls to keep you updated.

To maintain discipline, accuracy and to avoid collusion our system doesn't allow maker to know who is the checker.

Task timeline will let you track every action taken on your G.S.T return with date and time stamp.

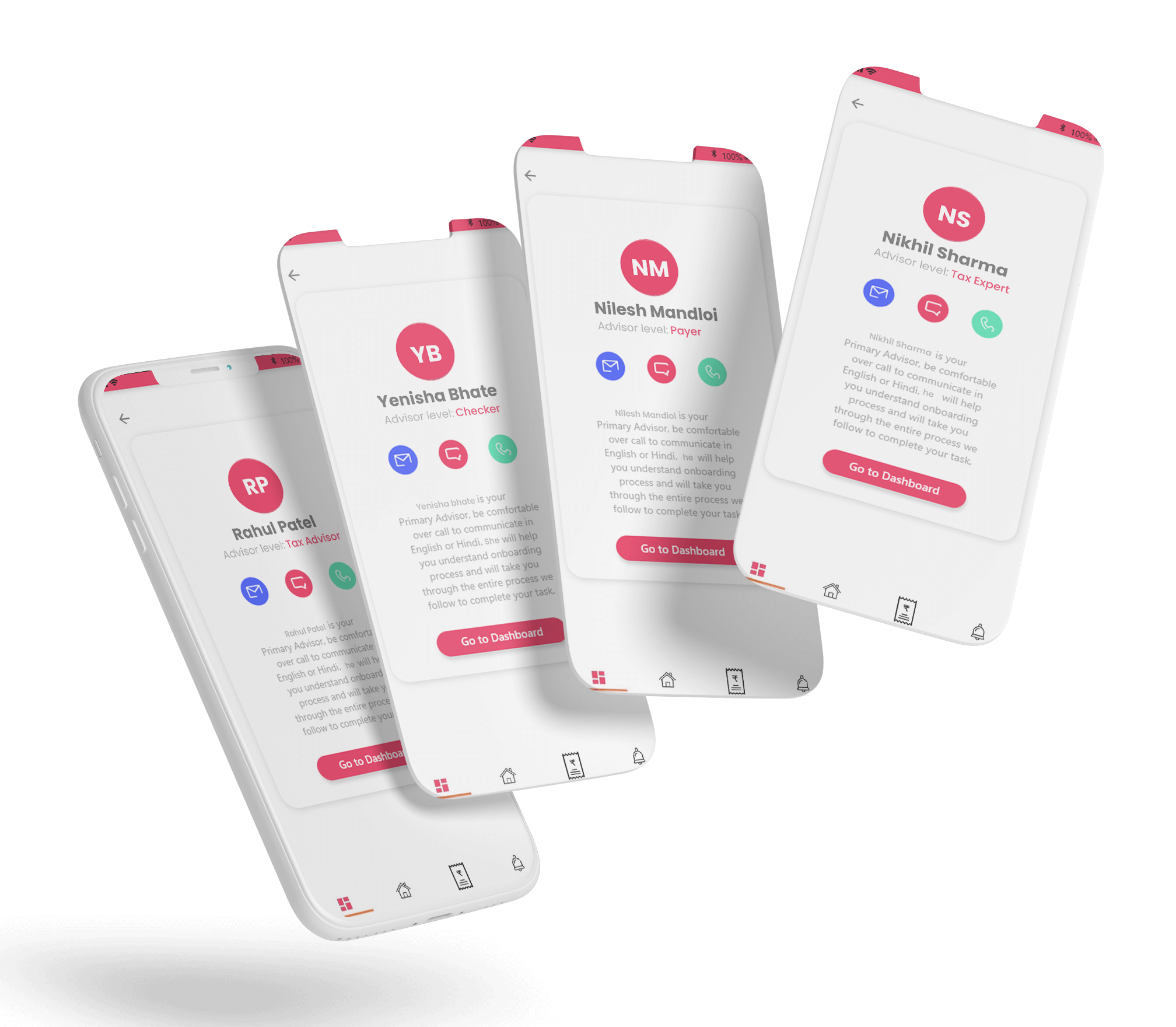

Now no need to save tax expert contact on your mobile just go to paper tax app and connect with your advisor at single click.

Maker is the first person

who interacts with the data

Checker ensure the critical

examination of details made by maker.

Payer ensures accurate tax payment

& provide dedicated support to client for payment.

After Signup/login you will be alloted with the primary advisor who will answer to all your initial queries/doubts and will let you understand onboarding process

With the exclusive website and mobile app loaded with GST services, just fill your cart with the service of your choice , pay & you are all set.

We will be requiring some basic information/documents such as PAN Number, the documents you have in support of filing of tax return, you need not to upload documents right away you can do it later.

With the live track facility you can track every action on your task, your advisor will prepare your draft tax return & provide you with the blueprint of your tax return for approval.

Have a look on each service, go throught what you will get in it and then select which is best for you.

Explore GST Services & Pricing Plans